Retirement Income

For baby boomers, the most difficult planning to do is converting from being an accumulator of assets to a spender. Today, many pre-retirees find the various options of creating retirement income quite daunting.

Social Security and retirement plan/pension plan distribution planning are two of the most sought-after services we provide.

Your investment choices are broad, as we are an independent practice, not tied to a particular company’s product.

Long-Term Care

Long-Term Care (LTC) planning is not the purchase of insurance to cover the cost of care caused by advanced age or incapacity. LTC planning is the discipline of thinking through all the “what-if” situations and the options available.

We often hear our clients’ children tell their parents not to worry about their long-term care because the children will provide for them. While our clients’ children have the best of intentions, the reality is they may not be equipped to provide the level of care needed.

- Can a child take time off from work to stay home and care for a parent?

- Are children prepared to provide the necessary physical care for their parents?

We listen for the nuances of what your family wants to help you make these difficult decisions. We also work with a local team of Elder-Care attorneys to tie long-term care planning with the overall estate plan.

Education Planning

The options for setting aside education funds for children and grandchildren have grown exponentially over the past two decades! We can help you determine an appropriate strategy to save for private primary school as well as college and advanced degrees. We are well versed in:

- 529 Savings Plans,

- Coverdell Plans,

- state-specific plans (MACs and MPACT),

- or private trust.

We help you take advantage of the reduction of the estate and income taxes techniques.

* Phillips Wealth Planners do not provide advice on tax or legal matters. Please discuss these matters with the appropriate professional.

HENRY Program

Many young investors may not have access to quality advice since they have not accumulated a large number of investment assets. HENRYs are often self-made and have worked their way through school or up the ladder and are at the beginning of their accumulation stage.

We designed our HENRY program (High Earners but Not Rich Yet) for those who have discretionary income, are serious about their money, and willing to commit to a monthly savings plan. We will go through our full financial planning process with you and address any risks that could derail your plan!

Business Planning and Exit Strategies

Since many of our clients are small business owners, we work with retiring business executives and business owners on “exit-planning” strategies for retirement, death or disability. Our business planning includes strategies:

- to protect against loss of a key employee

- help spouses or family receive the value of the business in the event of death or disability of the business owner.

Sustainable Investing (ESG)

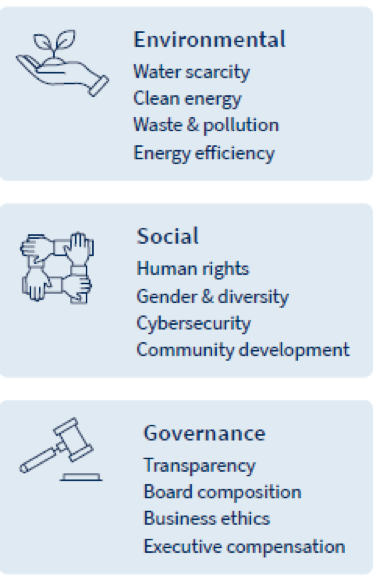

Sustainable investing integrates a variety of environmental, social and governance (ESG) criteria: how companies manage natural resources, treat their customers and workers, and run their businesses. A range of sustainability issues can be considered in assessing a company’s potential for long-term performance. Whether you desire to promote diversity and inclusion in the workplace, want to contribute to the transition to clean energy, or want to support companies with strong data privacy practices, we can help you align your investments with the causes you’re most passionate about.

Utilizing an ESG investment strategy may result in investment returns that may be lower or higher than if decisions were based solely on investment considerations.

Investing involves risk and you may incur a profit or loss regardless of the strategy selected. Sustainable/Socially Responsible Investing (SRI) considers qualitative environmental, social and corporate governance, also known as ESG criteria, which may be subjective in nature. There are additional risks associated with Sustainable/Socially Responsible Investing (SRI), including limited diversification and the potential for increased volatility. There is no guarantee that SRI products or strategies will produce returns similar to traditional investments. Because SRI criteria exclude certain securities/products for non-financial reasons, investors may forego some market opportunities available to those who do not use these criteria. Investors should consult their investment professional prior to making an investment decision. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Investments mentioned may not be suitable for all investors.